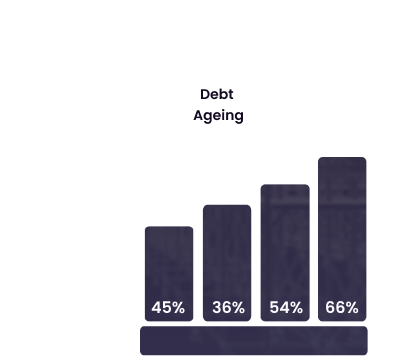

Debt Ageing

A successful customer relationship is the cornerstone of 21st century B2B. Think for a moment, how much time is spent on chasing payments and how your business may be losing on recurring customers?

Debt Ageing (Customer Late Payment Prediction) Module

Reduce trapped cash by reducing DSO (Days Sales Outstanding), improve your cash flow, reduce unnecessary expenses and get a competitive advantage by using the intelligent AI Debt ageing module from iERP. Our module will give you an opportunity to reduce your trapped cash by 30% just by reducing DSO!

Do you have experience with predictive analytics in your company? No internal resources to help deal with data challenges? Are you looking for an affordable but still accurate and precise solution? Claim your one-hour free consultation with one of our experts!

How We Do It

Our software solution is automatically combining and evaluating historical transaction data to create a precise prediction model and the AI engine evaluates existing or new invoices and payments.

How Does It Work

The software is on-premise and installed on your local environment in a matter of minutes and data is loaded from spreadsheets or imported from your ERP/CRM system. The application validates data and provides recommendations on potential data cleansing.

Software is working with your data locally, without sending data to the cloud so results can be reviewed directly in the software, exported as spreadsheets or you can use optional API integration into your ERP/CRM system. We care about data privacy.

The output is the prediction of customers and invoices which are likely to be paid late along with prediction confidence classification.

Benefits

- The Financial Industry anticipates that automation will improve the collections and deductions process and reduce key KPIs including DSO and DDO by up to 50%;

- On a survey, 88% of CFOs are expecting to deploy artificial intelligence within the next two years to support business growth.